What Should you know about applying for an FHA Mortgage?

FHA home loans differs from their conventional counterparts in many ways including a lower dowm payment requirements, generally more forgiving credit requirements, and occupancy rules. With a minimun of 3.5% if the buyer credit score is 580 or higher. FHA loans tipycally requires borrowers to occupy

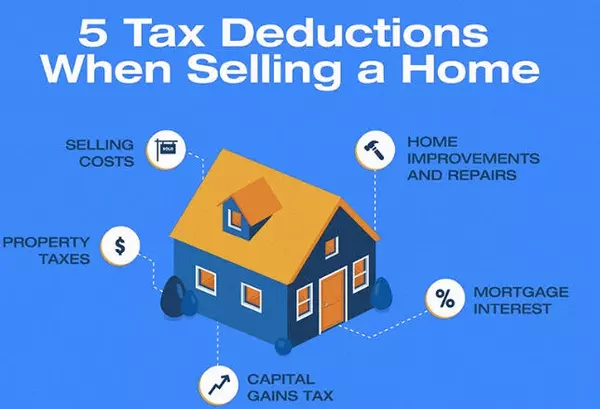

5 sweet tax deductions when selling a home

1. Selling costs are allowed as long as they are directly tied to the sale of the home, and you lived in the home for at least two of the five years preceding the sale. 2.Home improvements and repairs If you needed to make home improvements in order to sell your home, you can deduct those expenses a

6 Strategies to Improve Your Credit before Buying a House

Here are 6 key points to improve credit: 1.Balance: Knowing what your score is is the first step and the most important recommendation is that you pay the balances you have on all your credit cards. This helps increase your score. It's fine to use one of your credit cards, but always make sure to ke

Categories

Recent Posts